The main difference between the morning star candlestick and evening star candlestick patterns is that the morning star is considered a bullish indicator while the evening star is bearish. When buying and selling are almost the same this pattern occurs.

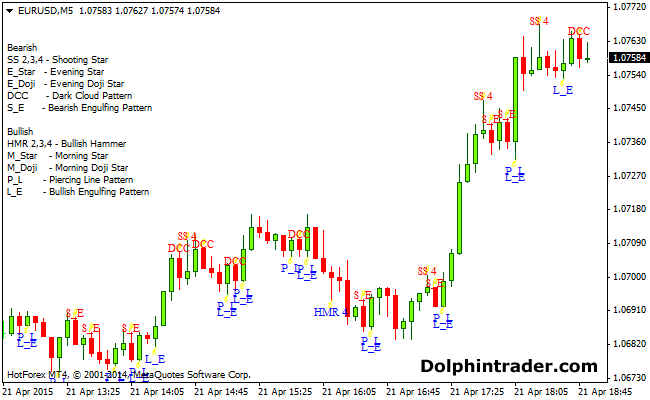

Candlestick Recognition Master Forex Indicator

Advanced Candlestick Pattern Indicator Mt4 Free

Mt4 Candlestick Patterns Indicator Scanner

A candlestick cheat sheet is a great tool to have when youre a new trader.

Candlestick pattern indicator. Price pattern scanner where I choose the pattern 4 replies. Any pattern referring to a white candle is a green candle today. A Shooting Star is a bearish reversal candlestick.

Technical Indicator Definition. It is completed by a long-bodied white. Long Legged Doji.

In the following sections Ill show you 20 candlestick patterns with examples. The patterns stayed the same but the colors changed. A hammer is a type of bullish reversal candlestick pattern made up of just one candle found in price charts of financial assetsThe candle looks like a hammer as it has a long lower wick and a short body at the top of the candlestick with little or no upper wick.

It is formed when three bearish candles follow a strong UPTREND indicating that a reversal is in the works. A bearish abandoned baby is a type of candlestick pattern identified by traders to signal a reversal in the current uptrend. Candle Patterns Indicator was designed to identify over 30 popular candlestick patterns.

The pattern is made up of three candles. The evening star has the middle candle at a higher peak than both side candles with a gap up followed by a gap down while the morning star has the middle candlestick the lowest with a gap down followed by. The candlestick pattern is favoured due to its simplicity and ease of analysis at a glance.

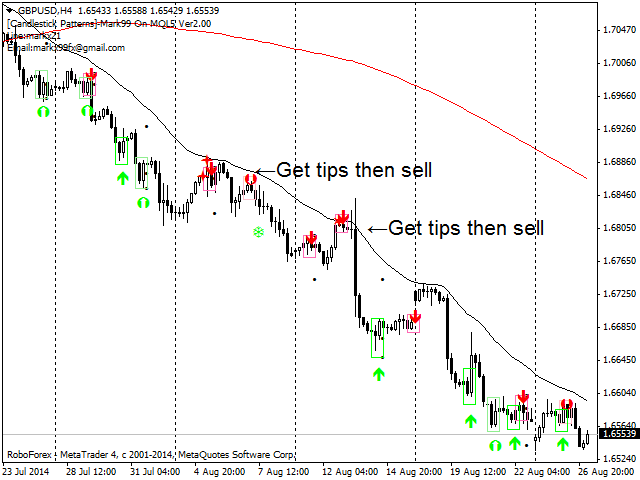

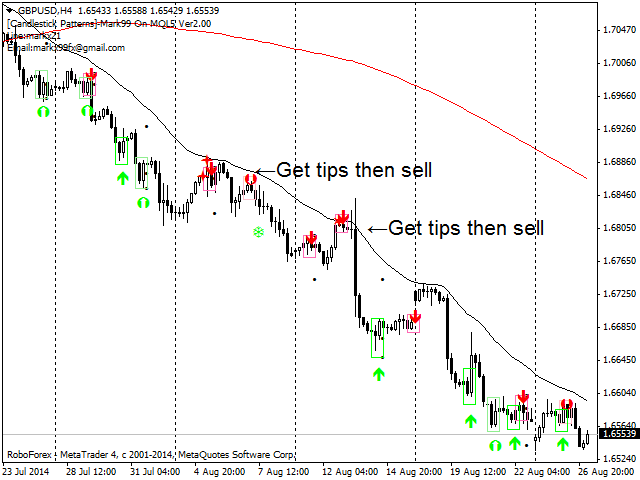

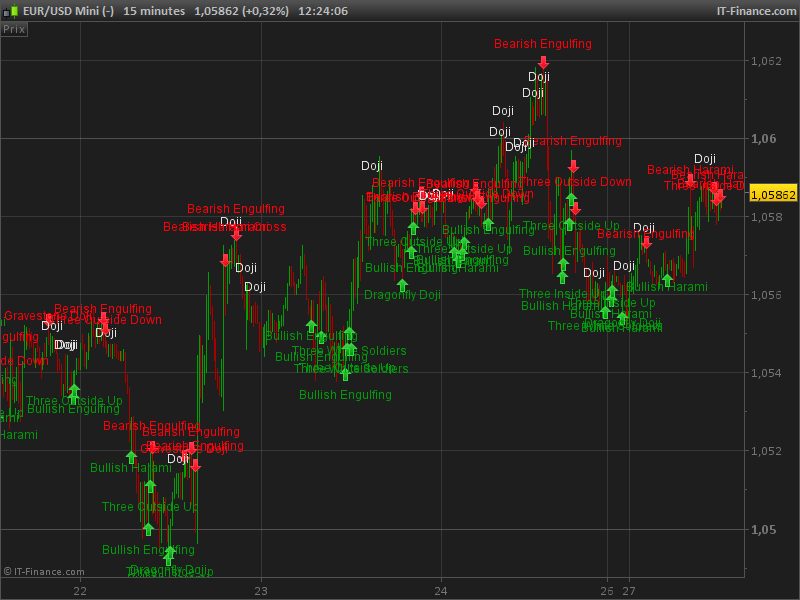

Candlestick Pattern indicator is an indicator for MetaTrader platform that can detect many of these patterns and show them on screen or to alert traders about them. The technical analysis proposes various tools to help traders determine trends and anticipate their reversals. Unlike the Bullish Engulfing Pattern which closes above the previous open the Piercing Pattern closes within the body of the previous candle.

The Inverted Hammer occurs when the price has been falling suggests the possibility of a reversal. Moving Average MA. In technical analysis candlestick patterns are used to predict future price movements based on the current chart trend.

It is somewhat similar to Pattern Recognition Master though they detect slightly different sets of candle patterns. We explore how the doji candle is formed top trading strategies for the most common doji patterns and more. On TradingView you can use Candlestick Pattern indicators to find these patterns on the chart.

They are an indicator for traders to consider opening a long position to profit from any upward trajectory. The next candlestick pattern indicator for MT4 is slightly better in terms of identifying patterns although it falls short in every other aspect. The future direction of the trend is uncertain as indicated by this Doji pattern.

As you may know there are several ways to display the historical price of an asset be it a forex pair company share or cryptocurrency. I decided to do a little investigation. It will have nearly or the same open and closing price with long shadows.

Candlestick pattern indicator 2 replies. An Inverted Hammer is a bullish reversal candlestick. Candlestick Scanner 1 reply.

Learn to trade forex with the doji candlestick pattern. Of course there is also a variety of candlestick patterns that signal bullish and bearish movements. It comes in both a bearish red or black and a bullish green or white form and it commands attention with its long and sturdy shape.

A morning star is a bullish reversal pattern where the first candlestick is long and blackred-bodied followed by short candlestick that has gapped lower. This is the most common type of Doji candlestick pattern. This reversal pattern is either bearish or bullish depending on the previous candles.

A rare candlestick pattern and the meaning behind it A Long Legged Doji occurs when the open and close is the same price but with a. The candle falls into the hammer group and is a first cousin of the hanging man hammer and inverted hammer. Bullish patterns may form after a market downtrend and signal a reversal of price movement.

The hammer candlestick pattern is formed of a short body with a long lower wick and is found at the bottom of a downward trend. Posted on January 25 2019 by Angel - Candlesticks Charting. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision.

You can easily identify whether it was a Buy candle or a Sell candle. Normally a long bearish candle followed by a short bullish or bearish doji or a small body candlestick which is then followed by a long bullish candle. A candlestick pattern is especially useful for traders to determine the possible price movement and market trends based on the past patterns.

The shooting star is a single bearish candlestick pattern that is common in technical analysis. A candlestick pattern is a price movement that is shown graphically on a candlestick chart. Much like the Doji the Marubozu candlestick pattern is a one-candle easy-to-spot signal with a very clear meaning.

And black and red mean the same thing. Looking for an open source MA scanner dashboard 0 replies. Both candlesticks have petite little bodies filled or hollow long upper shadows and small or absent lower shadows.

Forex Pattern Scanner without loading mt4 charts 16 replies. Besides technical indicators another great approach to analyzing the price action is the candlestick chart and its patterns. In fact even experienced traders can benefit from having a candlestick cheat sheet.

As the name suggests this is a long-legged candlestick pattern. In order for a candle to be a valid hammer most traders say the lower wick must be two times greater than the size of the body. It turned that when I changed the colours in the indicator settings which were black by default to the same colour a window popped up with a message patterns and they appeared in colours I did not select.

Candlestick Cheat Sheet Wallpaper Backgrounds and E-Book. The second candles body should be bigger than the first candle and should close at or very near its low. If youre unfamiliar with any of these patterns check out our Quick Reference Guide.

Youll see what each candlestick looks like in the context of a. To have a valid Morning Star formation most traders look for the top of the third candle to be at least halfway up the body of the first candle in the pattern. A Piercing Pattern is a 2-candle reversal candlestick pattern that forms after a decline in price.

The Three Black Crows candlestick pattern is just the opposite of the Three White Soldiers. It may look like a cross but it can have an extremely small body. The above also gives you different patterns and shapes that give a leading indicator of where the market may go.

Download The Markea Candlestick Patterns Free Technical Indicator For Metatrader 4 In Metatrader Market

16 Candlestick Patterns Every Trader Should Know Ig Sg

Candlesticks Patterns Indicator Indicators Prorealtime

Candlestick Patterns Tradingview

Forex Candlestick Patterns Metatrader 4 Indicator

Candlestick Pattern Recognition Indicator For Metatrader 4 Doji Candlestick Patterns Technical Indicators Mql5 Programming Forum

Frz Candlestick Pattern Indicator Mt4 Forex Robotz

8720 Free Forex Candlestick Mt4 Indicator Downloads See Reversal Continuation Patterns Easily Youtube